Let’s talk fertilityinsurance coverage

Understanding insurance coverage can be huge. Figuring out what’s covered and what’s not can get confusing and frustrating, and can impact your fertility plan. That’s why we’re here to help.

Understanding insurance coverage can be huge. Figuring out what’s covered and what’s not can get confusing and frustrating, and can impact your fertility plan. That’s why we’re here to help.

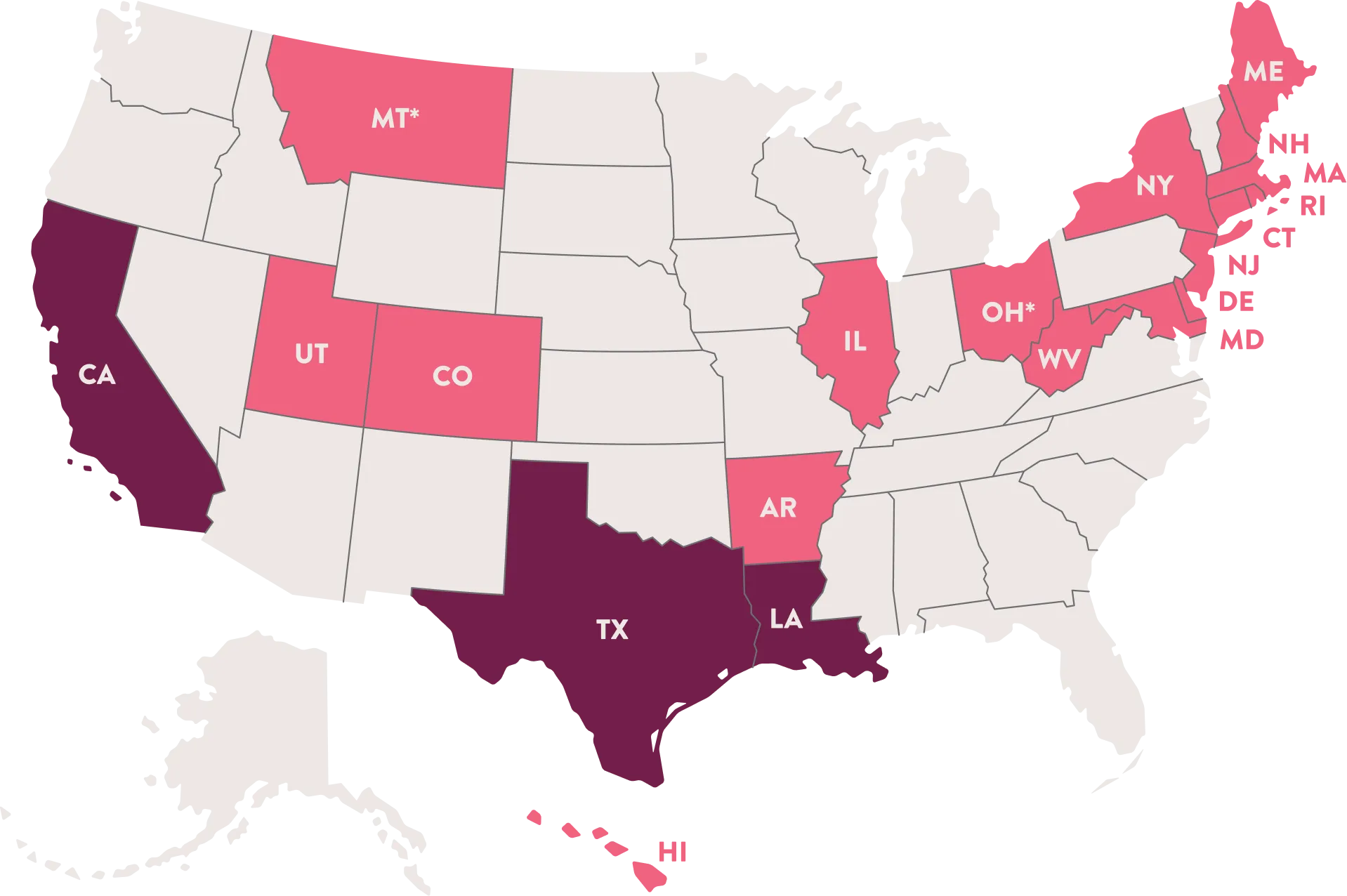

The state in which you or your partner works can make all the difference when it comes to covering fertility treatments. If your state mandates fertility coverage, that means some or all insurance providers are required to offer insurance benefits for fertility treatments.

As of 2022, 20 states have fertility insurance coverage laws.*Required by HMO only; other insurers are exempt.

Mandate to cover means that some or all insurance plans have to cover certain

fertility treatments.

Mandate to offer means that while insurance providers have to offer certain testing and treatment services, employers can decide which of those benefits, if any, to offer to people covered by their plan.

Great question! Generally, the state where your employer is located determines whether or not the state mandate applies to your employer-provided health insurance plan.

This can make a big difference in the coverage you can get. Most people are covered by group insurance policies, which can be public or private. However, some types of insurance are exempt from state mandates. Let’s break this down.

Public insurance includes government programs like Veterans Administration for people who’ve served in the armed forces and TRICARE, which covers current military personnel and their families.

There are no federal mandates that require public insurance to cover infertility. You should talk to your benefits provider to find out what services are covered for you.

Private insurance includes commercial insurance companies, like Aetna® and Cigna®, among others; nonprofit insurance companies, like Blue Cross®/Blue Shield®; and self-insuring groups, like employers who pay benefit claims directly instead of using an external insurance provider.

Self-insuring businesses are exempt from state mandates to provide or offer coverage. So, if your employer is self-insured, you should check with your HR representative or benefits manager to find out what’s covered for you.

Insurance can be complicated, we totally get it. So, we put together a list of terms and phrases we think may help.

Check it out >

For more information around insurance coverage, check out RESOLVE.org >

Enter your ZIP code for clinics in your area.

Ferring does not have responsibility for, or control of, the contents, availability, operation, or performance of other websites to which this website may be linked or from which this website may be accessed. Ferring makes no representation regarding the content of any other websites that you may access from this website.